Australia’s Argyle Diamond Mine, the source of 90% of the world’s pink diamonds, is scheduled to cease operations in 2020. What can this mean for the pink diamond market, the industry as a whole, and investors. Let’s find out.

Is the Argyle Mine Closing?

Yes, and soon. First discovered in 1979 and in operation as a mine since December 1985, the Argyle mine was facing depletion in the early 2010s. In 2013, the mine’s owner, natural resources conglomerate Rio Tinto, announced that it had opened a new underground section in the site, in an attempt to extend the life of this influential mine.

Bonus! If you are interested in getting additional colored diamond insight, be sure to download our free Colored Diamond Investment Guide:

Why not make another expansion?

If the mine’s life was extended for 7 whole years by making underground extensions why not make another underground expansion? In simple terms, it’s expensive.

Diamonds of any type require a huge amount of pressure, only forming at depths between 120 and 250 kilometers below the earth’s surface, making diamond mining a high-cost process. At some point (determined by the mining company) effort and expenses for diamond extraction outweigh the benefits. As such, by the end of 2020, the Argyle mine’s economically viable supply of diamonds will be exhausted, this is precisely what is prompting its closure.

Why should investors be on the lookout?

Simply put, the largest source of pink diamonds, the Argyle mine is about to close in 2020, and no mine has yet been found that can replace it.

Located in the remote East Kimberley region of Western Australia, the Argyle mine is the fourth largest diamond mine in the world by volume. It is also the source of 90% of the annual supply of world’s ultra-rare pink diamonds. Specifically, “ultra-rare” means, in a good year, one in a million diamonds discovered worldwide will be pink, which is a tiny fraction of global diamond production.

Moreover, while pink diamonds can be found in mines in other locales such as Russia, Brazil, and India, the Argyle site is renowned for the sheer quantity and quality of the pink diamonds it has produced over the years. This is especially true for the unique “bubble gum” hue of the Argyle pink diamonds, which is currently unmatched by any other worldwide in terms of depth, vibrancy, and saturation.

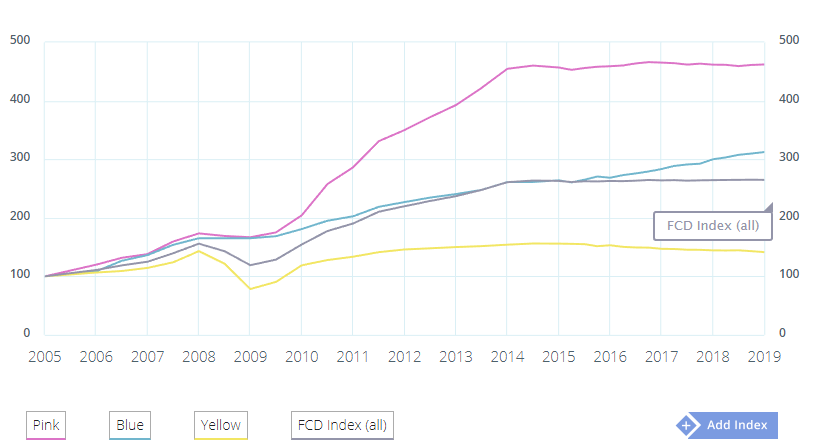

Pink diamond prices have been on the rise, appreciating steadily during the past decade. With the upcoming closure of the Argyle mine, the impact on supply will undoubtedly cause prices to rise a certain degree.

Pink Diamonds: Is There Any Upside to the Supply Contraction?

Record sales have been reported in each auction session. Market performance data shows a steady appreciation of the value of pink diamonds over the past decade as a whole, and a 400% increase in the most recent few years. Each year Rio Tinto holds an annual Argyle Pink Diamond Tender and each year’s tender outperforms the last; with the 2018 event being the most successful in the company’s history.

The public anticipation of the Argyle mine’s closure likely plays an important role in the price increase. Investors who already possess a pink diamond stand to gain from continued appreciation in these diamonds’ value over time. On the other hand, current non-owners will likely still be able to acquire such a stone through public or private auctions, albeit at a much higher price. It would therefore be right to assume that if one is to invest in pink diamonds, the time would be now, rather than later.

The Dual Nature of the Pink Diamond Market

According to Hamish Sharma, head of jewels for Sotheby’s Australia, there are two levels of markets for pink diamonds.

The first refers to low carat stones, most commonly used in pavé and for decorative purposes on jewelry. The assumption here would be that designers will most probably move to using other, more cost effective, materials once the Argyle mine closes. As such, the market impact is expected to be minimal.

The second level includes larger carat pink diamonds. Such diamonds (especially those with higher saturation and clarity levels) have always been beyond scarce, and extremely valuable. It is this market segment that will undoubtedly be impacted the most by the mine’s imminent closure, with prices expected to soar. This is further supported by pink diamond auction results during the past decade. According to Hamish Sharma “…If you chart the auction prices of the really serious stones over the past several years, you notice they continue to break records. It's a question of this extreme scarcity.”

London-based fashion journalist Marion Hume makes a related point, underlining that pink diamonds do not necessarily belong in the “mainstream” perception of luxury items. With such a limited supply chain, they’ve come to represent a highly refined taste. This essentially means that knowledge about them and their reputation exists only among the best jewelers and collectors in the world.

David Farnon, a director at one of Western Australia’s biggest jewelers, Linney Jewellery, shares Sharma and Hume’s optimism: “The market has understood for a while that there's a looming deadline, and prices have reflected that. So I think we'll be right, price wise, for at least the next five years. After that, it's hard to say.”

Pink Diamonds Consistently Beating the Stock Market

Farnon points out that pink diamonds of all sizes (not just the large stones) have consistently beaten the stock market averages. More specifically, he stated that pink diamonds have gone up between 10% and 15% each year, reliably beating the stock market. He further underlined that after property and art, pink diamonds might be an excellent investment asset for portfolio diversification.

Rio Tinto Copper and Diamonds Chief Executive Arnaud Soirat shares a similar view, stating that pink diamond prices have increased by 500% over the past 20 years, with price appreciation reaching double digit numbers; significantly higher, when compared to stock market price evolution.

Thus, pink diamonds’ prospects as an attractive alternative investment seem secure for the near future. The stones’ natural scarcity and desirability among a highly affluent segment of buyers protect their value. As well, the small size of the buying segment will ensure pink diamonds’ continued availability even in the absence of the Argyle mine. The occasional appearance of pink diamonds on the celebrity red carpet only add to the glamorous allure surrounding this diamond type. Examples include Jennifer Lopez’s 2002 engagement ring and the Argyle pink diamonds worn by Livia Guiggioli, Colin Firth’s wife, to the 2010 Oscars.

What Does the Close of Argyle Mean for the Broader Naturally Colored Diamond Market?

The short answer: Before the Argyle mine closes in 2020, investors should seek out the exceptionally rare varieties of naturally colored diamonds (pink, blue, and red.) While these stones do have potential for liquidation during the relative short term (5-10 years,) their true value (and thus profit for investors) will start to appear well after a decade.

As the fourth largest diamond mine in the world by volume, Argyle’s closure will undoubtedly have an impact on the broader naturally colored diamond market. Colored diamonds are the ultimate “needles in the haystack” yielding long-term returns in excess of 10% per annum.

Red and blue diamonds, which are also produced at Argyle, are exponentially rarer (and even more valuable) than pinks. The Argyle Muse was most valuable stone ever found at Argyle, a 2.28 carat fancy purplish red, which lies at the end of the official pink spectrum. Only 29 fancy red stones have been found at Argyle, and only a handful ever worldwide.

Diamonds are the world’s most portable form of wealth. The Argyle mine’s impending closing is a tragedy for colored diamond lovers, but it presents investors with a unique opportunity to lock in large returns by buying the rarest varieties of stones (pink, blue, and red) ahead of the mine’s closure at the end of 2020. Investors should note that all bids in the 2019 Argyle Pink Diamond Tender are due by October 9, 2019.

Closing Remarks

“Everyone in the colored diamond world has known the Argyle mine will be closing in 2020. When it does finally close, what might we expect to see in the market?

It’s impossible to know for certain how the future is going to play out, but there are some signs that might offer some insight.

First off, closing in 2020 does not mean closing on January 1, 2020. The mine is scheduled to close at the end of 2020. If you are reading this when originally posted, that is more than a full year away. Perhaps the biggest implication from this timing is that it allows for 2 (and possibly 3) more tenders to run. Expect those to occur in 2019, 2020 and possibly 1 more. Thus, the market may not “feel the lack of Argyle diamonds” until some point after 2021.

So, while the mine may close in 2020, the near-term investment horizon may be fairly stable. However, in 3+ years from now, when there are no more Argyle diamonds hitting the market, all bets are off; this could be the time the market drastically heats up. With no other source to replace this iconic mine anywhere in the foreseeable horizon, expect demand to continue to outpace available supply; with the more unique stones to have the greatest demand.”

What are your thoughts for the future of the diamond market? Are you thinking of investing in an Argyle Diamond? Let us know! And as always feel free to follow us on LinkedIn and Twitter.

For more reading on colored diamonds, see the links below: