In April of 2017, a diamond sold at Sotheby's Hong Kong auction for $71.2 million dollars. At 59.6-carats, it was certainly a large stone, but not nearly large enough to justify its record-smashing winning bid. What made this particular diamond so unique? It was pink.

The State of the Market: Trends are Changing

With the global stock market in a constant state of flux, more and more people are turning to tangible investments like real estate and treasure assets to protect their wealth. Among treasure assets, loose stones are seeing a big spike in popularity; and colored diamonds have risen to the forefront as one of the most stable and lucrative investments you can make.

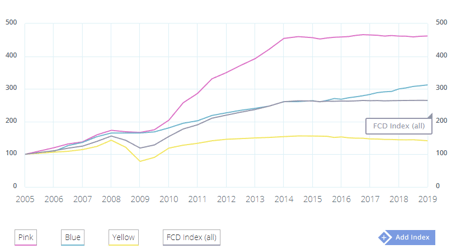

So why should you consider jumping on the trend of colored stones, especially pink diamonds? Simply put, pink diamond prices have seen the most significant growth out of all colored diamond categories

Bonus! If you are interested in getting additional colored diamond insight, be sure to download our free Colored Diamond Investment Guide:

Pink Diamonds: A Stable and Growing Alternative Investment

While not necessarily a new alternative, colored diamonds have been gaining traction as an investment asset all over the world, especially in recent years. More specifically, in Barclay’s Wealth’s report on 2014 investment trends, 70% of their respondents to a worldwide survey had begun investing in precious jewelry, officially making it the most popular treasure asset in the world. From then, numbers have only been rising as more and more investors possess more treasure assets than they did five years ago. (With pink diamonds in particular seeing a significant boost in demand during the past decade.)

But why colored diamonds? Simply put, their rarity makes them a very stable buy. Only one diamond in every ten thousand is naturally colored, making it essentially impossible for the market to become flooded or the prices to crash by other means. And as any investor knows, a stable, long-term trend is always a good indicator of a solid investment opportunity with real potential to pay off. Having said that however, there are even degrees of rarity among the various color categories, with pink diamonds being among the rarest. Another crucial factor contributing to their immense increase in demand and price.

Why Invest in Pink Diamonds?

Pink diamonds have seen a huge surge in interest in recent years. The main reason behind this is that they are getting more rare by the minute, and at some time in the not so distant future, they might even be finite.

The premier supplier of naturally colored pink diamonds is the Argyle Mine in Australia. The mine is not only responsible for producing over 90% of the world’s pink diamonds, it is also famous for bringing us some of the most beautiful colored stones with a hue unrivaled by any other. Unfortunately, the Argyle Mine is nearing the exhaustion of its resources and according to official statements, it is scheduled to close in 2020.

Pink Diamonds as a Wearable Investment

In addition to their stability in value, pink diamonds (and all other colored diamonds of course) have seen an increase in popularity as a tangible investment due to their ability to be easily stored and moved. As opposed to larger tangible assets such as antique furniture, classic cars, real-estate, or paintings, colored stones are highly portable and can be either stored right after purchase, or be later set in jewelry (if bought loose,) allowing you to wear and enjoy your investment.

Loose Pink Diamonds or Jewelry?

Investing in jewelry may be tempting, but experts recommend purchasing loose pink diamonds. Like we mentioned previously, loose stones may be stored, or may be set as wearable pieces.

Companies focusing on investment grade diamonds offer the most competitive prices, as well as the best quality. Investors must be wary when purchasing preset stones. Oftentimes these diamonds are selected to match the specific setting or might be set in ways that hide various imperfections, and might not have optimal cut, clarity, and saturation that would yield the highest price at an auction. Furthermore, in the case of future liquidation of your asset, loose stones seem to be easier to sell than those already set in a piece of jewelry.

A Few Final Words

Pink diamonds are a unique investment opportunity. Their rarity makes them a stable selection, and the closure of the Argyle Mine is driving their price higher and higher. They’re an option worth considering for qualified investors looking for a stable treasure investment with a great chance of paying off high dividends in the future.

For more reading on alternative investments, click the links below, and as always feel free to follow us on Twitter and LinkedIn.

For more reading on colored diamonds, see the links below: