Oil prices, the Coronavirus, and stock market fluctuations have the global financial market in a current state of turmoil. While this is indeed concerning, things always get worse before they get better, as they say. We need to remain calm and positive until all this rolls over. But what you currently might be thinking as investors is “how can I secure my wealth?”

In times of economic uncertainty, investors turn to tangible assets like art and gold to protect their wealth. Among these assets, loose diamonds see big spikes in popularity; and colored diamonds traditionally have risen to the forefront as one of the most stable and lucrative investments you can make during these times.

Bonus! If you are interested in getting additional colored diamond insight, be sure to download our free Colored Diamond Investment Guide below or schedule a meeting with one of our seasoned diamond experts:

Pink Diamonds: A Stable and Growing Alternative Investment

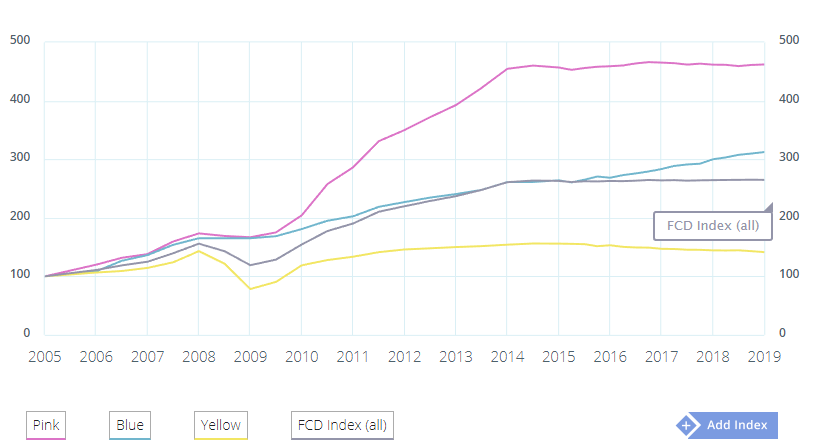

Drawing correlations from the last financial crisis, as economic woes deepen investment focus shifts to hard assets. The last significant time of financial turmoil was experienced during the 2008 financial crisis and subsequent recession. As we can see from the graph below, colored diamonds, and in particular pink diamonds, saw a significant increase as investors turned to treasure assets to diversify and strengthen their portfolios.

But why colored diamonds? Simply put, they are extremely rare and can provide significant wealth security.

Only one diamond in every ten thousand is naturally colored, making it essentially impossible to flood the market or crash prices by other means. As any investor knows, a stable, long-term trend is always a good indicator of a solid investment opportunity with real potential to pay off. Having said that however, not every diamond color is made equal. There are varying degrees of rarity among the various color categories, with pink diamonds being among the rarest. Another crucial factor contributing to their immense increase in demand and price.

Why Invest in Pink Diamonds?

Pink diamonds have seen a spike in interest during recent years. This is mainly because they are getting rarer by the minute as the iconic Argyle mine, the producer of the Argyle Pink diamonds, ceases operations by the end of 2020.

The Argyle Mine in Australia is the premier supplier of naturally colored pink diamonds. The mine is not only responsible for producing over 90% of the world’s pink diamonds, it is also famous for bringing us some of the most beautiful colored stones with a hue unrivaled by any other. The Argyle Mine is nearing the exhaustion of its resources and according to official statements, it is by the end of this year.

Pink Diamonds as a Secure and Portable Investment

In addition to value security, pink diamonds have seen an increase in a surge in popularity as a tangible investment due to their ability to be easily stored and moved. Contrary to larger tangible assets like paintings, classic cars, antique furniture, and real-estate, colored diamonds are highly portable and durable, and can be either stored right after purchase, or be later set in jewelry (if bought loose,) allowing you to enjoy and wear your investment.

Loose Pink Diamonds or Jewelry?

When deciding between investing in loose or set diamonds, the latter is always the more enticing option from a visual aspect, but is it the best? Experts recommend the opposite, purchasing loose pink diamonds is better in the long run. But why specifically go for loose pink diamonds?

As investors you must be wary when purchasing preset stones. Oftentimes these diamonds might be set in ways that hide various imperfections, and might not have optimal cut, clarity, and saturation that would yield the highest price at an auction, or are selected specifically to match a certain setting. Furthermore, if you are thinking of liquefying your asset, loose diamonds are much easier to sell than those already set in a piece of jewelry.

The Verdict

Pink diamonds are a unique investment opportunity, especially during times of economic uncertainty. Their rarity makes them a stable selection, and the closure of the Argyle Mine will only continue to impact their value. They’re an option worth considering

for qualified investors looking for a stable treasure investment to offset market instability.

For more reading on alternative investments, click the links below, and as always feel free to

follow us on Twitter and LinkedIn.

For more reading on colored diamonds, see the links below:

- Pink Diamonds - Year by Year Price Review

- What To Look For In A Diamond Investment

- Which Colored Diamonds Should I Invest In?

- Colored Diamonds Investment - 6 Tips You Need To Know