While the emergence of the pandemic has shaken the modern world to its foundation, that's not a cause for pessimism. Investors must learn to keep calm, analyze, and adapt. So what do you do in a time of economic uncertainty?

One thing you might want to consider is diversifying and improving your resiliency via alternative investments. Alternative investments exist off of the stock market, and many of them prove more stable in times of a crisis as compared to more “traditional” investments.

What Is An Alternative Investment?

Simply put, an alternative investment is simply any non-traditional investment. The field of traditional investments is relatively narrow, and primarily encompasses stocks and bonds. As a result, there are countless types of alternative investments that exist outside of the normal financial system. Some choices of alternative investment are obvious, such as commodities, while others might come as a surprise.

Types of Alternative Investments to Consider

As it happens, the list of lucrative alternative investments includes classic cars, collectables, and even aged wine. The interesting thing about these assets though is that they all fall under the category of “finer things in life”. Most of these (and many more not even mentioned bellow) are assets that most people enjoy collecting or consuming. They enjoy following the trends in the niches, so why not take the next step and invest in them?

Alternative Investment 1: Fine Wine

Wine is one popular form of alternative investment, as are other types of aged alcoholic beverages. The underlying logic of such investments are easy to see, given the dynamics of the market. As wine ages, it has two factors at play that serve to make it more valuable. For one, the superior taste and stable demand for luxurious vintages mean that it's easy to turn a profit selling it. On the other, the supply of similar vintages necessarily contracts each year due to consumption. This can have impressive results on value, as one 73-year old Burgundy sold for over half a million dollars. While you'll hardly hold onto an investment wine for a lifetime, more modest vintages are still profitable.

This alternative investment is relatively safe and a good choice for portfolio diversification. The main drawback of investing in aged alcohols is that besides money, a considerable investment of time is also necessary. Not to mention, wine will not generate any sort of dividends or passive income during the aging process. Nonetheless, this is one area to look into as you explore the possibility of alternative investments.

Alternative Investment 2: Collectibles

Collectibles are a broad category that encompasses any limited, collectible good. Autographed sports memorabilia, trading cards, mint condition videogames, and more can sell at incredibly high prices. In 2014, a rare British Guiana stamp sold for almost $9.5 million. Anything that people collect as a hobby can be a sound investment if it's in good shape and you can keep it as such.

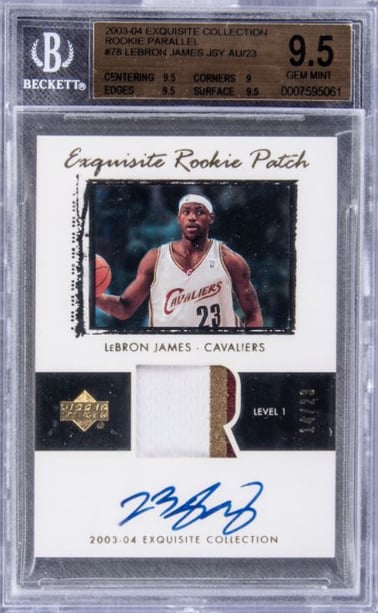

As long as interest remains in a certain collectible, it will retain and even increase its value. Factors such as limited print/manufacture runs, diminishing supply due to the passage of time, and others can increase the worth of collectibles. As a result, some collectibles are entirely safe investments due to the fact that continued public interest is a virtually sure bet. Additionally, the passion of collectors can often surprise you. In July 2020, an owner of the Exquisite Collection LeBron James rookie card put it up for auction. Projected value fell at $1 million, an estimate which the sale price of $1.8 million quickly blew away.

On the other hand, it can be somewhat difficult to enter the collectible market. Purchasing collectibles that are already valuable and waiting for their value to appreciate is expensive. Buying new products that are likely to become valuable collectibles in the future is more financially accessible, but essentially boils down to guesswork.

Alternative Investment 3: Natural Colored Diamonds

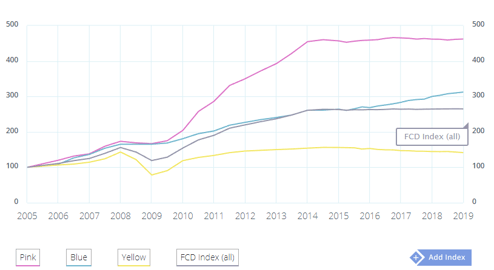

Luxurious natural colored diamonds are fairly easy alternative investment choices. While you'll need a secure location to store them, owning them is hands-off compared to other alternative investments. The global rarity of natural colored diamonds and their increasing popularity both serve to make the exotic gemstones more valuable and reliable as investments. If you examine the value of colored diamonds throughout the years, you'll see they've historically resisted economic downturns quite well. Although, this varies based on color.

In the aftermath of the 2008 crash, yellow diamonds suffered the most and posted the poorest recovery. On the other hand, blue diamonds and pink diamonds spent the years leading up to 2008 increasing in value and then paused. Once the economic recovery started, blue diamonds saw a stable increase in value while pink diamonds virtually skyrocketed before stabilizing in 2014.

Ease of investment and reliability are strong advantages in favor of investing in colored diamonds now and into the future. However, they're especially appealing in the midst of the Coronavirus pandemic due to the nature of the crisis. As logistical centers cease working, the supply of readily-available colored diamonds is contracting. Overall, treasure assets and pink diamonds in particular are valuable elements of your portfolio that can help guard against uncertainty and inflation.

Alternative Investment 4: Cryptocurrency

Where did gold coins gain their value in the past, and where does paper currency derive its value from today? The fact that people will accept these forms of currency in exchange for goods and services; neither gold nor dollar bills possess any innate value. However, modern fiat currencies rely on management via a central bank or various state apparatuses. These serve to minimize volatility or manipulate the value of a currency in line with national policy. While the average person hardly loses sleep over the machinations of central banks, these concerns are a driving force that helped create and sustain the cryptocurrency industry.

Cryptocurrencies have seen astronomical increases in value in recent years, in spite of Bitcoin's infamous burst. The economies that accept bitcoin and other coins, such as ethereum, have grown steadily. Many online retailers are beginning to accept alternative currencies, and a private cryptocurrency investment bank is set to launch in 2021. Overall, cryptocurrency has shown real staying power and is certainly an exciting choice of alternative investment.

Bitcoin however is not the only cryptocurrency investors turn to. There are other very notable options, including:

- Ethereum

- Ripple XRP

- Litecoin

- NEO

- IOTA

And if you are a fan of Elon Musk and enjoy the occasional meme, Dogecoin might be another cryptocurrency you might want to be on the lookout for.

Alternative Investment 5: Art

Art is one of the most famous and flexible choices for alternative investments. Valuable, historic art can easily sell for millions of dollars and typically appreciates with time. For instance, just look at Leonardo da Vinci's Salvator Mundi, which caught an impressive price tag of more than $450 million. However, it's necessary to take care to make sure that the art doesn't degrade with time or suffer some sort of damage. Depending on the type of art, maintenance and care can become a delicate, time-consuming process.

Photo From Christie's

Dust removal and other types of cleaning are essential to maintain the beauty and value of an artwork. However, these processes require a sharp eye, a delicate touch, and specialized equipment that won't damage the art. The risk that comes with cleaning art on your own simply is not worth it. As a result, it's necessary for any aspiring art investors to set aside a budget for professional cleaning and maintenance. Additionally, a secure storage location where the art is safe from insects and other hazards is a must.

If you're looking to invest in art by purchasing known works with a high value, you'll face a high cost of entry. However, it's possible to enter the art investment industry with just a few hundred dollars if you want to seek out unknown artists. Buying directly from active artists pursuing art as a passion project will mean you can expect to get numerous works for a relatively low cost. While asset appreciation is not a foregone conclusion in this case, this may be acceptable given the affordability of lesser-known artworks. This sort of accessibility is a large part of why art is among the most popular alternative investment groups of all.

Alternative Investment 6: Domain Names

A domain name might be worth nothing more than the monthly leasing fee you pay to registrars such as GoDaddy or Bluehost. However, a domain might also be worth more than your entire net worth. For instance, the Farmers Bureau owned fb.com for years until they sold it off for a tidy sum to Facebook. More specifically, Facebook bought fb.com for an impressive $8.5 million in 2010, while the Farmers Bureau moved over to fb.org.

While most domains are worthless and some are worth millions of dollars, many are worth tens or hundreds of thousands of dollars. The value of a domain is a tricky thing to evaluate, but it generally hinges on the concept of brandability. This refers to how easily a business could incorporate the domain name into their branding.

Concise, catchy domain names are more brandable and thus more valuable, particularly when they end in .com or .co. One to three-word domains that use correct spelling are one example of a brandable, valuable domain, particularly when these form a marketable phrase. Domains that consist of strings of three or four letters are also typically valuable, since they can easily translate into countless different abbreviations. Thanks to domain auctions and the ability to backorder expired domains, it's possible to catch valuable domains below their market price as well. While this is a fairly niche market, it's also an entirely sound choice for diversifying your portfolio.

Alternative Investment 7: Real Estate

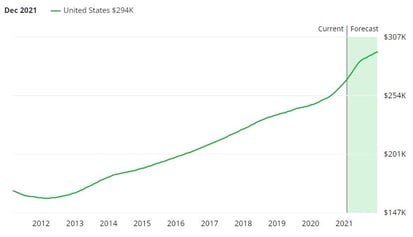

Real estate is one of the most popular investments, whether conventional or alternative. However, your options aren't limited to REIT's. Investing in property allows you to secure considerable passive income via charging rent. In the long-term, property investments often appreciate in value due to rising costs of land as well as active efforts to increase the value of your property.

Even as Coronavirus wrought havoc on the global economy, the value of real estate rose by 7.5% over the course of 2020. As a result, it's easy to see why real estate has such a reputation as being a safe investment. However, this investment does come with considerable costs in regard to maintenance and upkeep. If you know or are able to learn how to perform basic property maintenance tasks, you can increase your profit margins significantly. Assuming you have the capital to begin investing in real estate, the other main drawback to real estate investment is that working with tenants can often be trying. If you're not prepared to handle difficult people and evict them when necessary, real estate isn't for you. But if you can take care of a property, handle tenants, and have the capital to begin investing, history shows that real estate is a reliable, profitable choice.

These options represent an eclectic mixture of popular, obscure, and interesting alternative investments. What they do not represent is the full scope of alternative investments, which is a topic that's so expansive it would require its own book.

The Verdict

This is only the tip of the alternative investment iceberg, there are many more option out there that might fit investment habits or interest better. While this post was made to introduce the concept of alternative investments, its deeper purpose was “food for thought”.

People tend to gravitate towards what they know and what they enjoy focusing on. This is what needs to be used as a baseline to help you determine your alternative investment path.

Do you have any questions? Which alternative assets are you currently investing in? Let us know in the comments bellow.