In recent years, colored diamonds have become more and more popular. Not only are these stones beautiful, but they also provide immense value for investors. In fact, colored diamonds have not reported any major depreciation in over 37 years.

Arpège Diamonds kicks off this series by comparing fancy colored diamonds to gold investments. In the upcoming weeks, be sure to look out for more in-depth comparisons between colored diamonds and other common investments.

What Makes Colored Diamonds So Special?

This is an easy question to answer. Colored diamonds are extremely unique and rare. Out of all the diamonds in the world, approximately only 1% are colored diamonds. These stones get their color from chemical impurities in their atomic structures such as the addition of boron or hydrogen. In the case of red diamonds, these stones get their color from high stress during their formation. Only 20 to 30 pure red colored diamonds have been found. (Due to this fact, red diamonds are the most rare diamonds in the world.)

In the colored diamond industry, the general rule of thumb is: the more vibrant and structurally perfect the diamond, the more expensive the stone. Most recently, The Pink Star sold for $71 million. You can read more about it here.

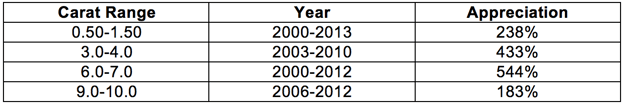

Colored Diamonds As An Investment

Colored diamonds are have not shown any notable depreciation in over 37 years. These alternative investments have mainly been unaffected by global recessions or even political turmoil. To top it off, fancy colored diamonds have steadily maintained their value, and some cases even shown substantial appreciation.

One of the benefits of investing in colored diamonds is that they’re easy to move if need be. These stones can fit in the palm of your hands. If chosen as an investment, the buyer can wear the diamond, store the diamond in a personal safe, or have the ability to choose whatever they may please with the stones. This can’t be said about other tradition investments such as stocks or gold.

Gold As An Investment

For centuries, gold has been used a form of currency and has been appreciated for its high value as both as an investment and jewelry. One downside of investing in gold however is that if it’s not purchased for the purpose of jewelry, the investor acquires ownership of the gold on paper. But what if there’s an emergency or you simply want to physically have the investment in hand? With gold, it isn't that easy...

When looking at gold at an investment standpoint, the first set of data to look at is its worth. Over time, gold has increased and is going in the right direction; however there have been many drastic fluctuations both up and down. If you look at the period after the financial crisis struck, the value of gold spiked as investors started looking for more secure investments. As the market improved since 2011, the price of gold has seen a steady decline.

What Now?

Colored diamonds are finite in number. With the closure of the Argyle mine in the very near future, supply will cease to grow and that will impact the future value of colored diamonds. If you're asking yourself "when's the best time to invest?", perhaps the answer might be now.

If you are unsure about how to position your investments in fancy colored diamonds, Arpège Diamonds stands ready to help. With over 50 years of combined industry experience, we'll help you gather the most effective information and insights so that you can make educated decisions on your fancy colored diamond investing. You can contact us at 866-821-5508 for a personalized review.

For more reading on colored diamonds, see the links below: