Colored diamonds have been admired for their beauty and value for hundreds of years. Within the last few decades, many types of colored diamonds have been growing in value, but one hue of colored diamond has outpaced all others. Since 2005, pink diamond price has increased by an average of 15% per year.

In this article we will be looking at:

- Some of history's record breaking pink diamonds

- Why investors are turning their heads towards pink diamonds

- The importance of the Argyle Mine

- The potential future of pink diamonds and brief estimates on how their value might evolve

Record Breaking Colored and Pink Diamonds

Within the last 10 years, diamonds of all colors have continually broken records for sale prices, including superstars like The Blue Moon- a blue diamond, The Cora Sundrop- a yellow diamond, and The Aurora Green- a green diamond.

But the undisputed star of the last 10 years has been the pink diamond. Auction prices for pink diamonds have seen an average value per carat climb to over $2 million. Among the highest sales of pink diamonds are:

- The Pink Promise Diamond - 14.93 carat, type IIa, oval mixed cut, VVS1, Fancy Vivid Pink diamond sold for $31.86 million.

- The Graff Pink Diamond - A 23.88 carat rectangular cut, Internally Flawless, Vivid Pink that sold for $46 million.

- The Pink Legacy Diamond - A 18.96 carat, VS1, emerald cut, Fancy Vivid Pink diamond that sold for $50 million.

- The Pink Star Diamond - A 59.60 carat, oval mixed cut, Internally Flawless, IIa graded, Fancy Vivid Pink that shattered all previous records for colored diamonds, yielding $71.2 million.

The Pink Star Diamond

The Evolution of Pink Diamond Prices and Value

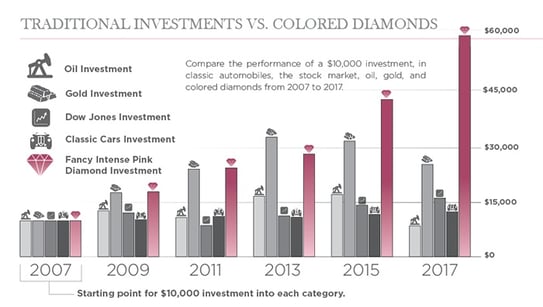

Investors have taken a particularly fond interest in pink diamonds as a form of alternative investing. Pink diamonds have become a popular option both for their continual growth, as well as their portability. Unlike other commodities like gold that are difficult to transport in large quantities, the most valuable pink diamonds can be carried with ease. Investors also appreciate the stability of colored diamonds, especially pink diamonds. Unlike the volatility of the stock market, colored diamonds have shown steady and exponential appreciation.

The Argyle Mine

The source for the majority of the pink diamonds is the Argyle Mine in Kimberly, Australia. The mine is responsible for 0.1% of the world's colored diamond production, but produces approximately 90% of the pink diamonds in the world.

Despite its massively influential position in the industry, Rio Tinto, the owner of the Argyle Mine, has announced the forecasted closure of the mine by the year 2020. This is potentially due to diminishing resources, and technological limitations challenging further mine expansion.

What Does This Mean for the Future of Pink Diamonds?

With the impending cessation of mining operations at the Argyle Mine, supply is anticipated to drastically drop over the next couple of years. As this supply dwindles, demand is expected to continue to grow, forcing pink diamond prices to go higher and higher.

This is even more apparent from the previous graph. We saw that since 2007, pink diamonds have seen a considerable appreciation, exceeding that of 500% their initial value in recent years.

Whether you are looking to purchase a pink diamond for is beauty or for its ever-increasing value, now is the time to buy. As the production of pink diamonds at the Rio Tinto mine ceases, pink diamonds will be in an even shorter supply. Be sure to take a look at our collection of colored diamonds when considering your next investment purchase.

For more reading on colored diamonds, see the links below:

- Sparkling Alternative Investments for 2017

- Investing in Natural Pink Diamonds: What You Need to Know

- Need To Know: How To Invest In Colored Diamonds

- Do You Have This Alternative Investment Asset In Your Portfolio?