Diamonds are one of those unique investments that can be purchased in one currency and sold in another, providing a hedge against inflation that devalues the purchasing currency. Like we’ve mentioned in previous articles, diamonds are tangible investments that are highly portable, easy to store, and of course wearable.

In this article we will be looking at:

- Why colored diamonds are getting exponentially rarer

- How colored diamonds have become a safe haven for investors

- What a billionaire investor did, and what we can learn from him

Why are Colored Diamonds Getting Rarer?

While colorless diamonds are relatively easy to come across, colored diamonds bring a whole new meaning to the word “rare”. More specifically for every 10,000 stones that are mined, only 1 will be a colored diamond.

Colored diamonds are becoming harder to find and even harder to mine. Some of the longest producing mines are nearing the end of their profitable life. A good example would be the famous Argyle Mine in Western Australia. This mine has been responsible for producing 90% of the world pink diamonds, with a quality unrivaled by any other globally.

However, the 2020 closure of the Argyle Mine will not only affect the diamond production industry, it will also greatly impact the investment market, and possibly history as a whole. For more information about these speculations, check out our article here… but for the time being let’s not get off topic.

The exhaustion of mines is not the only issue, many companies are also greatly limited by the current mining technology. This means that even if there were hills of pink diamonds, at the levels of current technology it would not be feasible, time effective, or even profitable to extract them.

So the question remains, with all the above in mind, how will colored diamond investing change in the future?

Colored Diamonds are a Safe Haven for Investors

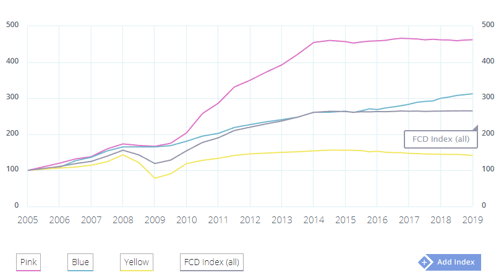

Fancy color diamonds are seen as a stable asset class, and have been so for some time. Total appreciation between 2005 and 2019 for pinks, blues, and yellows has been exponential as we can see from the FCDR Index provided below. Truly massive numbers if one takes into account that they were documented during a great financial crisis.

Furthermore, rough diamond prices dropped 2 years ago, but it did not extend to fancy colored diamonds. (Thankfully, the latter have yet to experience any side effects even today.)

It is therefore safe to assume that fancy colored stones are still seen as a safe haven within the industry, as they are largely unaffected by financial turmoil.

If you're interested in colored diamonds, check out this article to see which colored diamonds are right for you to invest in.

A Lesson from a Seasoned Billionaire Investor

As noted, colored diamonds are a stable asset class, and if you take into account the tactics of Joseph Lau, billionaire investor, we can see why. In the last few years, this investor has had a history of purchasing high-value stones for his daughters.

These stones, while outside the reach of most individual investors, are nonetheless part of a comprehensive wealth management system that doubtlessly includes estate planning. Stones passed as gifts or held in trust for minor children may be classed as gifts rather than as items of an estate, and taxed at a different rate; or if held as part of a living family trust, may not be taxed at all. Consult your tax experts for specific insight here.

A highly competent attorney, specializing in wills, trusts, and estates can help you plan your estate to preserve value, minimize tax hits, and circumvent the probate courts.

The Takeaway

Whatever your reason for choosing to invest in colored diamonds, you owe it to yourself and your family to educate yourself in your chosen investment strategy. Alternative investments have less liquidity than traditional investments and can require a longer outlook than stocks, bonds, and other instruments.

If you are unsure about how to position your investments in fancy colored diamonds, Arpège Diamonds stands ready to help. With over 50 years of combined industry experience, we'll help you gather the most effective information and insights so that you can make educated decisions on your fancy colored diamond investing. You can contact us at 866-821-5508 for a personalized review.

For more reading on alternative investments, click the links below and as always feel free to follow us on Twitter and LinkedIn.

- Why Colored Diamonds Are The Investment You're Looking For

- Do You Have This Alternative Investment Asset In Your Portfolio?

- How Do Auctions Work For Colored Diamonds?

- 3 Things You Need If You Want To Invest In Fancy Colored Diamonds

- Why Colored Diamonds Are The Investment You're Looking For

- Should I Invest In Loose Or Set Colored Diamonds?